On Tariffs, Mahagenco, Vedanta, CPCB and Haryana’s costly TPP - Issue #129

The world is in the grip of absolute uncertainty.

The Big Picture

In the second week, Trump’s tariff saw an intensification, a temporary reprieve, a waiver and the denial of said waiver. The first was on China, which saw Trump push tariffs up to 145% after Xi’s government responded aggressively. He has further hiked import tariffs on some Chinese goods as high as 245%. The second was a 90-day pause for close to half the countries in Trump’s cross-sights. And the third was a waiver for Chinese-made smartphones, electronics and solar cells.

Two days later, however, the US President denied any waiver had been granted and said these goods were simply moving into a different levy “bucket”. If anything, as US Commerce Secretary Howard Lutnick said, the new levy will be in addition to the global tariffs already imposed by Trump. “We need our medicines and we need semiconductors and our electronics to be built in America," he said.

There is no dearth of commentary on why these moves might boomerang. Tariff walls can all too easily result in profiteering and inefficiency. Within the RE sector, Trump’s moves seem incomprehensible unless he is serious about dismantling green manufacturing in the USA. China is hegemonic in the renewable energy sector. Can the USA wall China off— even imposing tariffs on critical minerals — and replicate its success? How long will it take the country to, well, reinvent the wheel?

As this newsletter gets written, Trump’s approval ratings are falling. As are US bonds and gold. “When risky assets fall in price, that’s one thing,” wrote FT. “But when the safe assets take a hit, you really are in trouble. The mechanism here is two-fold. One is fund managers scrambling to meet redemption demands. The other is margin calls — demands from banks that hedge funds stump up cash to plug the gap on failing trades. These demands are flooding in at the fastest pace since the depths of the pandemic.”

And so, the world is in the grip of absolute uncertainty. Will Trump double down? Or will the tariff war end soon — or perhaps after the US mid-term polls in late 2026?

Instead of speculating on possibilities, ergo, a more useful question is how countries are responding to this political risk. Are poorer countries contacting the White House, offering to drop import tariffs or buy more from the US, while more affluent economies like China, Canada, Japan and the EU strike more defiant notes, announcing countermeasures and starting trade talks with other countries?

As goods start getting redirected from the US to other markets, what happens to the US? And what happens to other markets? Is this only a threat or do they also get commodities like steel and RE equipment like solar panels at cheaper rates than before?

A report, published in CarbonCopy on Wednesday, looks at these possibilities for the global south. It’s not all gloom and doom.

PS: The tariff war is roiling the world in every way imaginable. Wary of Trump using energy as a bargaining chip, the EU is wondering whether it should resume supplies from Gazprom. Between a rock and a hard place.

News of the week

The tariff war has a habit of making the rest of the world look positively uneventful. And yet, it’s anything but dull.

The week gone by has seen five consequential events. First, India’s nuclear power sector has now decisively stepped into uncharted waters. On the heels of Holtec USA’s announcement, where it said it will transfer its SMR technology with Tata, L&T and Holtec Asia, comes another announcement. Mahagenco — not the Department of Atomic Energy or Nuclear Power Corporation of India Limited (NPCIL) — has tied up with Rosatom to make Thorium-based SMRs.

The questions come tripping out. Even if this is just a manufacturing agreement, why is Rosatom tying up with Mahagenco? Why not NPCIL? In its dispatch on Wednesday, The India Cable piled onto this development.

“So what’s wrong with this? Pretty much everything,” wrote Siddharth Varadarajan. “First, atomic energy is in the Union list under the Seventh Schedule of the Constitution and not the state or concurrent list. Second, under the allocation of business rules, ‘international relations in matters connected with atomic energy and nuclear science’ is the responsibility of the Department of Atomic Energy and not of state government undertakings. Third, Government of India companies can own and operate nuclear power plants, but not state government entities. Yes, last December, the NPCIL issued a Request for Proposal from the private sector for setting up captive 220MW ‘Bharat Small Reactors’, but the role of the private sector is to only be confined to putting up the money and using the power generated. The reactors themselves would be run by NPCIL. Finally, Rosatom and Russia do not even have thorium technology. In fact, thorium fuelled reactors do not yet exist—although they have been the holy grail of the Indian atomic establishment for decades—and as and when the technology is developed, it will more likely be by the experts at DAE rather than Mahagenco.”

For its part, NPCIL is now talking to central PSUs and state governments, proposing to set up nuclear plants for them. Its key offer here is its 700 MW reactor. There was yet more news from the sector. As CarbonCopy has written earlier, NTPC indeed wants to install SMRs at its older coal-based power plants. All in all. It is time for a relook at India’s nuclear sector.

Second. What is happening to thermal power plant (TPP) economics? Last week saw an announcement that one more TPP is coming up — this time in Haryana. The 800 MW project will cost Rs 8,470 crore. The questions, once more, come tripping out. Have TPP costs crossed Rs 10 crore/MW? “Around 2003, the fixed cost of setting up a coal-based power plant stood at Rs 4 crore a MW,” CarbonCopy had written in 2021. At that time, when the article was written, fixed costs for TPPs had climbed to Rs 5 crore/MW. How can the Haryana plant cost Rs 10 crore/MW after just four years? It’s coming up on 233 acres of land. How much can the government be paying for this land? Even at Rs 10 crore/acre, that still works out to Rs 6 crore/MW. This is not adding up.

Energy Trends posed this question to a power sector official. After noting that “thermal power capex is now priced three times that of solar,” the official said: “Land is one part of inflation. Second. Thermal power turbines are not being manufactured, and therefore, BHEL and others have to custom-produce at a higher cost. But the real cost is the transactional cost of contractors/politicians/officials.”

How competitive can such a TPP be? This needs a closer look.

Last week also underscored the need for a closer look at Assam’s oil and gas plans. Vedanta wants to invest Rs 50,000 crore in Assam's oil and gas sector. “"With such an investment, we will produce 1,00,000 barrels of oil and gas per day,” said Himanta Biswa Sarma. Vedanta’s announcement is event #3.

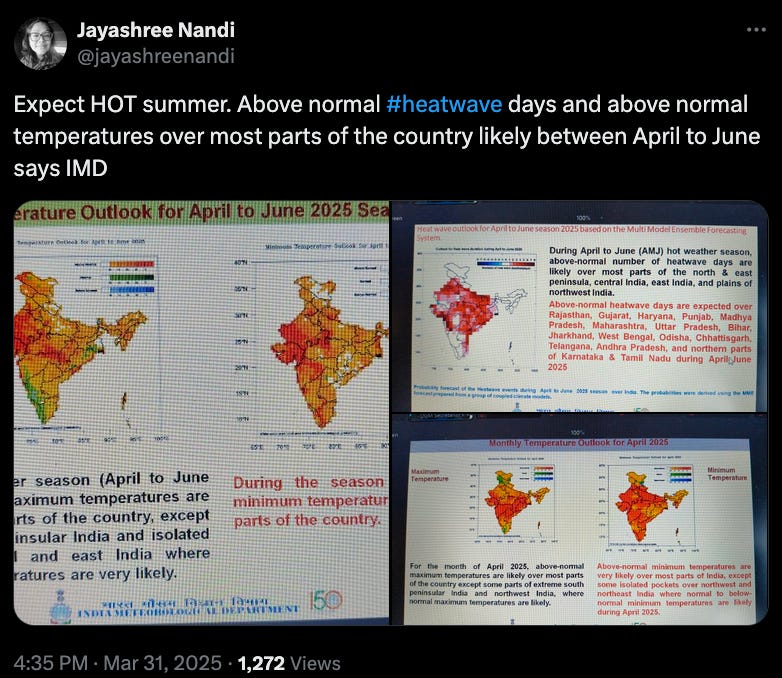

The fourth is heatwaves. They have started earlier than usual. Maharashtra reported 34 heatstroke cases in early April itself. As this newsletter gets written, heatwave warnings have been issued for northern and western India. On the whole, temperature anomalies are already piling up. Last week Indiaspend described the after-effects of these changes. March and April are considered spring months in India. As these months start seeing hotter days and nights, what does it mean for people’s health, agriculture, water and food security?

Last week was one more reminder that nature’s warnings don’t affect our decisions. Even as India commissions fresh TPPs and doubles down on oil and gas exploration while facing intensifying heatwaves, the Central Pollution Control Board (CPCB) is doing its bit by relaxing pollution standards.

“[CPCB] has carved a new category of industries called the ‘blue category’ industries based on the Essential Environmental Services (EES) for managing the pollution due to anthropogenic activities,” reported Down To Earth. “While the addition of important services in waste management such as composting, biogas, material recovery facilities and sewage treatment plants is a welcome move, the inclusion of waste-to-energy (WTE) incineration, which is the process of burning unsegregated municipal solid waste (MSW) to produce dirty electricity, is a huge retrograde step.

And finally, and more happily, event #6. “The Karnataka cabinet on Friday, April 11, approved a landmark bill aimed at creating a dedicated welfare fund for gig workers employed by major aggregator platforms such as Amazon, Flipkart, Ola, and Uber,” reported The News Minute. “The Platform Based Gig Workers (Social Security and Welfare) Bill… seeks to introduce a 1–5% cess on aggregator platforms to generate funds for the welfare of gig workers. The bill also provides for the creation of a Gig Workers’ Welfare Board, similar to the welfare board that exists for construction workers.”

Climate long-reads of the week

Trump’s EPA Plans to Stop Collecting Greenhouse Gas Emissions Data From Most Polluters(ProPublica)

NOAA Scientists Are Cleaning Bathrooms and Reconsidering Lab Experiments After Contracts for Basic Services Expire (ProPublica)

Donald Trump’s economic masterplan, by Yanis Varoufakis. This is a positive take. (Diem)

Debunking the Pettis-Miran Hypotheses. Policy Tensor rips apart Trump’s trade balance argument.

A scientist is paid to study maple syrup. He’s also paid to promote it (The Examination)

Big Tech’s data centre push will take water from the world’s driest areas (Source Material)

Why the shipping industry’s new carbon tax is a big deal — and still not enough (Grist)

Back to the skies: the unlikely comeback of one of Brazil’s rarest parrots (Mongaybay). Meanwhile, back in India. We have illegal bird markets.

Books of the week

We have two books of the week.

The first of these, which we just finished reading, is about the rowing team which won the gold in Hitler’s 1936 Olympics. If you run a team and want to remake them into a high-performance team, this is one book to read. In the middle, the boatbuilder tells a rower that it is not enough to want to win, that he should want his team-mates to win. That is The Boys In The Boat: Nine Americans and Their Epic Quest for Gold at the 1936 Berlin Olympics.

Our second book is something we just heard about. More and More and More: An All-Consuming History of Energy. As its abstract says: “It has become habitual to think of our relationship with energy as one of transition: with wood superseded by coal, coal by oil, oil by nuclear and then at some future point all replaced by green sources. Jean-Baptiste Fressoz’s devastating but unnervingly entertaining book shows what an extraordinary delusion this is. Far from the industrial era passing through a series of transformations, each new phase has in practice remained almost wholly entangled with the previous one. Indeed the very idea of transition turns out to be untrue. The author shares the same acute anxiety about the need for a green transition as the rest of us, but shows how, disastrously, our industrial history has in fact been based on symbiosis, with each major energy source feeding off the others…. The world now burns more wood and coal than ever before. This book reveals an uncomfortable truth: ‘transition’ was originally itself promoted by energy companies, not as a genuine plan, but as a means to put off any meaningful change.”